If your lender immediately applies each payment, youll pay down your principal significantly faster, which means youll accumulate less interest. Can't afford to pay off other debt That means you will make two $800 payments on a $1,600 mortgage instead of a single $1,600 payment. You are Either way you go, youre paying off your home and gaining equity much faster than planned, and thats a great thing! Coming up with another $954.83 and then some (depending on your taxes, insurance and mortgage insurance) in one big lump isnt happening.

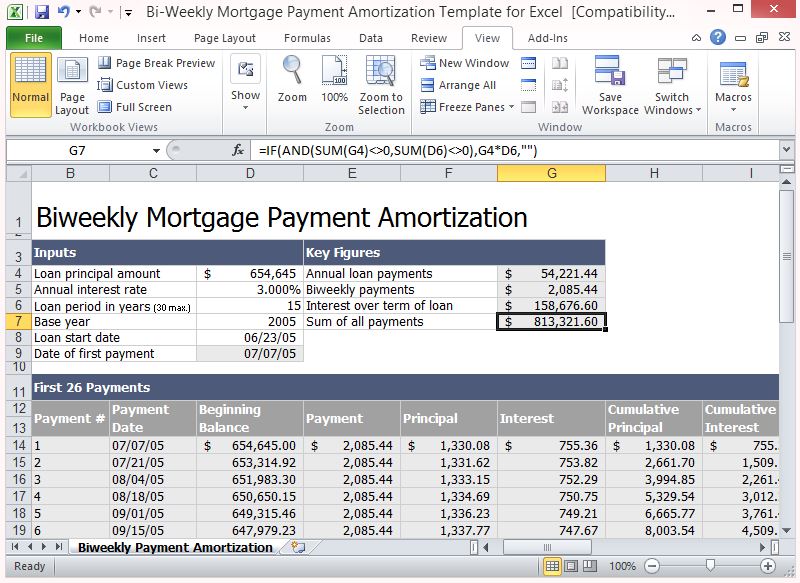

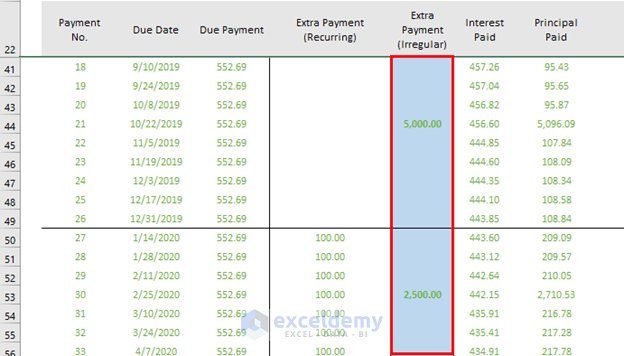

A smart move is to talk to your lender and ask for this option making sure you get an opportunity to save money and pay off your loan faster. The third column will show you how many months sooner you will pay off the mortgage by making biweekly payments instead of monthly payments. Borrowers will see exactly how much they can save with biweekly mortgage payments and how many years earlier can they pay off their mortgages. No one else can take it from you or make any decisions regarding itas long as you dont count the lender who holds your mortgage. If we include all these fees in our calculation, the. Adding to the bi-weekly module of payment if you are able to squeeze in some extra payment, it would really help you to save a great deal of money and also reduce your loan tenure furthermore. Your monthly and annual payments would look like this: Pros and Cons of. If you are paid biweekly, making biweekly mortgage payments may make more sense.

0 kommentar(er)

0 kommentar(er)